"We won't apologize for being Zionist," Finance Minister Yair Lapid said Monday, in response to outspoken criticism of his plan to grant a substantial tax exemption to Israelis who serve in the Israel Defense Forces or national service programs. "The criteria announced yesterday, under which anyone who served in the military will get a much larger benefit than those who didn't serve, communicate a very clear message: Those who give more, contribute more, get more," Lapid said. "The State of Israel is allowed to fight for its values, and is allowed to decide that there is a correlation between enjoying rights and fulfilling duties. That is what we did." According to the Finance Ministry decision, former soldiers and Israelis who take part in national service programs will enjoy a value added tax exemption when buying homes worth up to 1.6 million shekels ($462,000). Israelis who do not serve will only enjoy an exemption on houses worth up to 600,000 shekels ($173,000). The VAT stands at 18 percent, shaving a substantial amount from the purchase price. In 2013, the average cost of a four-room apartment in Tel Aviv was 2.7 million shekels ($780,000), in Jerusalem was 1.7 million shekels ($490,000), and in the cheapest big city, Beersheba, was 843,000 shekels ($244,000). "The chief parameter at the heart of the [tax exemption] debate was the issue of making military or national service a prerequisite for eligibility," said a Finance Ministry official on Sunday, adding that the question was thoroughly debated as the Attorney-General's Office refused to approve any exemption that would not apply to all sectors of Israeli society. Lapid's associates suggested that the full memorandum outlining the new law, including all the eligibility criteria and other conditions, would be made public in the coming days for the public to appeal. A Lapid spokesperson said that throughout the debate, the minister insisted on clear and substantial preferential terms for Israelis who contribute through military or national service. Ultimately, a compromise was reached to give Israelis who served a full exemption when purchasing their first home, as long as the value of the home does not exceed 1.6 million shekels including VAT (as assessed by a government-appointed real estate appraiser). Israelis who do not meet these criteria will be eligible for a VAT exemption on homes worth up to 600,000 shekels, making the exemption less relevant as there are very few homes built in Israel that are worth this amount or less. The VAT exemption has sparked bitter controversy within the Finance Ministry and among the highest ranking finance officials. Economist Michael Sharel, a former senior Finance Ministry official has stepped down over the exemption, going as far as issuing a biting letter of objection to the move. Bank of Israel Governor Karnit Flug has also voiced her stern objection, warning that the move could result in grave financial distortions. One of the main concerns surrounding the exemption is that it will stimulate real estate demand -- a field in which the demand already exceeds the supply. Another hurdle in the debate was the list of criteria, beyond the military service criterion. Ultimately, it was decided that the basic criteria would be that the home be purchased entirely by the person applying for the exemption, and that it would their first home. Likewise, the person or couple applying for the exemption cannot have purchased an apartment in the past, even if the deal was never completed. Clear discrimination Following the Finance Ministry announcement, Housing Minister Uri Ariel spoke with Deputy Attorney-General Avi Licht and informed him that there were virtually no apartments for sale for 600,000 shekels on the market. According to the Housing Ministry, in 2013 there were only 364 real estate purchases under the 600,000 shekel mark. In 2012 there were 212 purchases. Ariel's office issued a statement saying that the minister "supports giving preferential terms to Israelis who serve in the military or national service programs but he opposes the absolute exclusion of entire sectors from the tax exemption program. Based on his experience with the housing market and the various Israeli sectors, he believes that the criteria for Israelis who don't serve should be for homes worth 950,000 shekels or below." Meretz Chairwoman Zehava Gal-On also issued a response, saying that "Lapid's approach, preferring ex-soldiers when handing out housing benefits, ignores the fact that in the current stark real estate reality, with housing prices skyrocketing, there is no differentiation between Arabs and Jews. Ironically, the finance minister's solution, which involves a substantial investment of tax funds, is clearly discriminatory. A state is permitted to reward those who contribute, but it must do so under the principle of equality." Gal-On's colleague, fellow Meretz member Issawi Frej, said: "Lapid is continuing to institute racial discrimination under the guise of military service, this time with the support of the attorney-general, who fulfilled his obligation by handing out benefits to Arab and ultra-Orthodox Israelis on nonexistent apartments." Finance Committee Chairman Nissan Slomiansky (Habayit Hayehudi) welcomed the finance minister's tax exemption program, voicing his satisfaction over the fact that Israelis who did not serve would also be included. "Since there are nearly no apartments on the market valued at 600,000 shekels including VAT, I join the housing minister's call to raise the exemption to 950,000 shekels for Israelis who don't serve," Slomiansky said. MK Itzik Shmuli (Labor) criticized the program, saying: "Lapid knows full well that these criteria will prevent the program from passing the Knesset and later the High Court of Justice, but still, he chose to insist on them. That is not how someone who feels compelled to resolve the problem behaves. That is how a person who seeks momentary headlines behaves." MK Moshe Gafni (United Torah Judaism) said, "I surmise that this program will not be able to gain majority approval. It will not cause housing prices to drop, it will only cause racial discrimination." Fellow UTJ MK Meir Porush said, "Lapid is using the IDF like an ax with which to hack at the ultra-Orthodox." Shas MK Yakov Asher said that "the criterion issued by the Finance Ministry would be worthy of any anti-Semitic government. The ultra-Orthodox will buy apartments for 600,000 shekels on Mars maybe."

"A young person who contributes three years of his life is a good, worthy citizen who deserves a clear and obvious advantage," Lapid said.

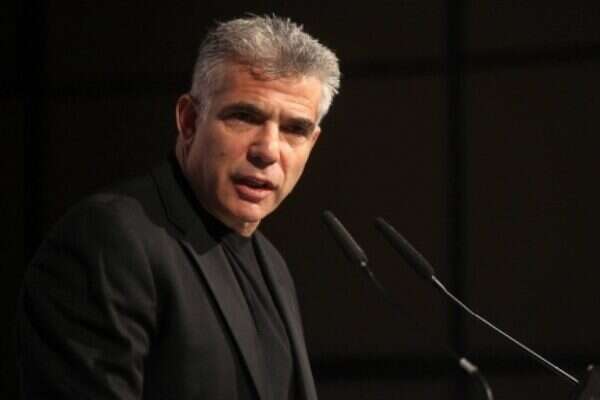

Speaking at an economic conference in Tel Aviv, the finance minister came out in defense of the tax exemption program that his ministry announced on Sunday, which gives a substantially higher tax exemption to Israelis who serve than those who do not chiefly Arab and ultra-Orthodox Israelis, who are exempt from military service.

Finance minister: We won't apologize for being Zionist

Finance Ministry issues criteria for tax exemption program giving Israelis who serve in the military a substantial discount on purchase of first home, with lesser benefits for Israelis who don't serve • Meretz chief calls program "clearly discriminatory."

Load more...